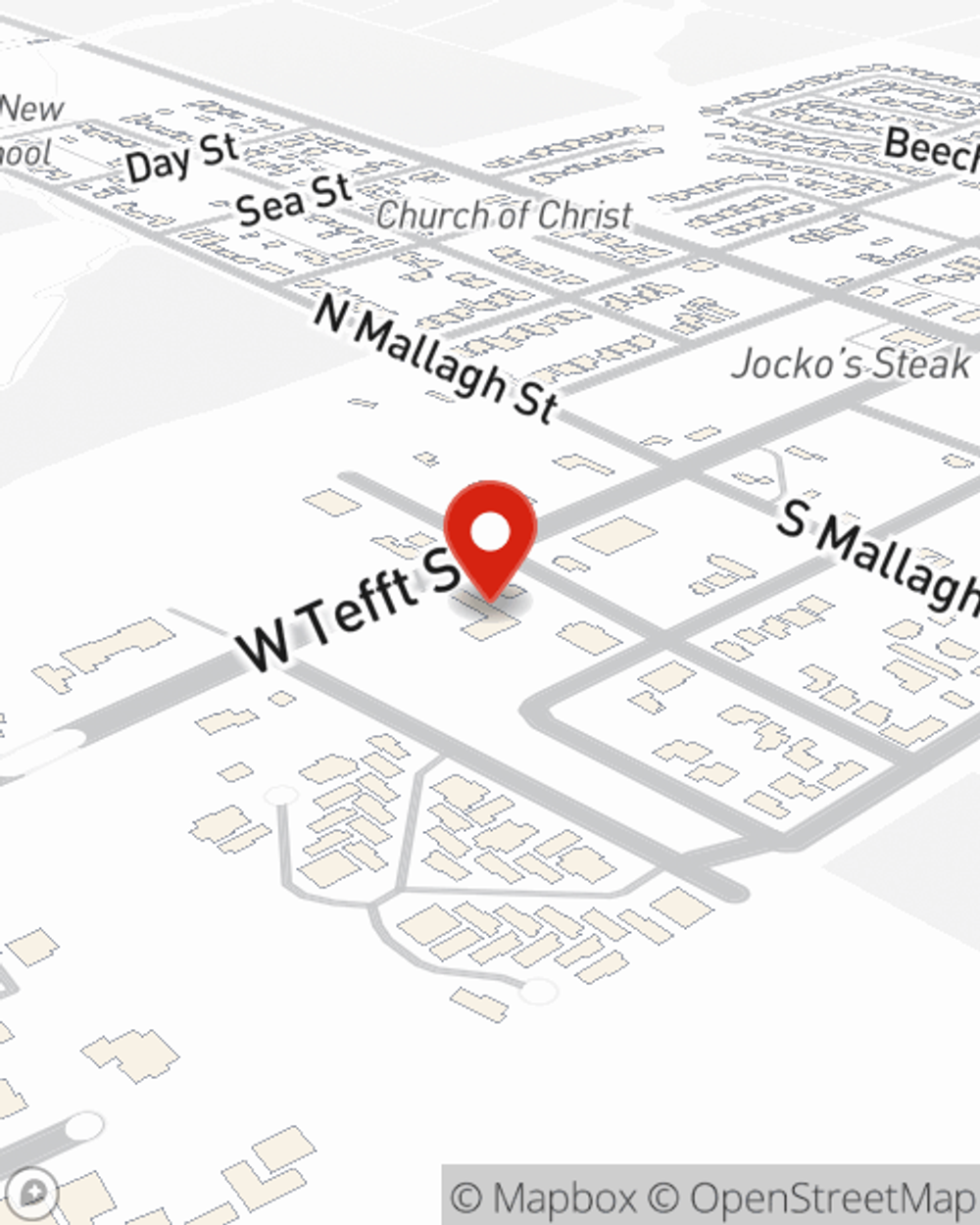

Business Insurance in and around Nipomo

One of Nipomo’s top choices for small business insurance.

This small business insurance is not risky

This Coverage Is Worth It.

Preparation is key for when an accident happens on your business's property like an employee getting injured.

One of Nipomo’s top choices for small business insurance.

This small business insurance is not risky

Small Business Insurance You Can Count On

The unexpected is, well, unexpected, but it's better to expect it so that you're prepared. State Farm has a wide range of coverages, like a surety or fidelity bond or errors and omissions liability, that can be formed to develop a personalized policy to fit your small business's needs. And when the unexpected does arise, agent Dale Lane can also help you file your claim.

Ready to investigate the specific options that may be right for you and your small business? Simply contact State Farm agent Dale Lane today!

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Dale Lane

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.